Rupee crashes to all-time low of 69.92 against dollar on Turkish Lira shock

The fall in the broader market was sharper, with two stocks declining for every one advancing on the BSE

Bowing to a global rout in currencies on fears of an economic crisis in Turkey, the rupee on Monday nosedived by Rs 1.09 to close at an all-time low of Rs 69.92 against the US dollar. It was the biggest single-day fall in almost five years.

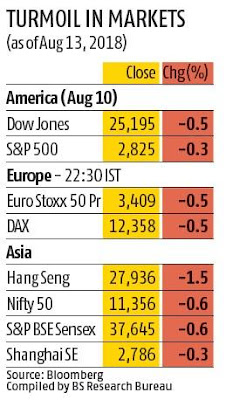

The apprehensions about turmoil in the Turkish economy engulfing world markets also pushed the Indian stock market index into a tailspin. The benchmark Sensex and Nifty fell over half a percent each, with metals and banking stocks leading the fall.

The fall in the broader market was sharper, with two stocks declining for every one advancing on the BSE. The Sensex declined 0.6 percent, or 224 points, to end at 37,644.9, while the Nifty fell 0.65 percent, or 74 points, to close at 11,356. Lack of foreign institutional investment inflows and growing oil prices are also affecting the rupee.

Foreign investors sold shares worth Rs 9.72 billion on the net basis, the provisional exchange data showed.

The US dollar strengthened against other currencies after the Turkish lira dived almost 8 percent, sparking a sell-off in the global markets. “The rupee was mainly affected by the fall in the Turkish lira,” Treasury executives said.

The rupee has dipped by 8.7 percent to date in the year. The lira lost its value by 45 percent and the Russian ruble by about 15 percent. Bank currency dealers said the Reserve Bank of India would not be comfortable at these levels. It (the RBI) was seen in the market, acting through bank treasuries, to contain volatility in the rupee at all levels. The Indian currency may test the crucial threshold of Rs 70 to a US greenback soon.

The rupee had opened stronger by 41 paise at 68.42 against the dollar in early trade on Monday, helped by revived sentiments, following an optimistic macroeconomic outlook.

However, it soon plunged in line with the weakening domestic equities and meltdown in the global markets. Suspected RBI intervention helped it recover from heavy losses, but heavy dollar demand pushed down the rupee again.

Besides currency market woes, Indian currency is also vulnerable to global crude oil prices and trade wars. Flagging risks from global trade battles, RBI Governor Urjit Patel, after the monetary policy review last week, had said, “We have already had a few months of turbulence behind us and it looks this is going to continue, for how long I do not know.”

“The trade skirmishes evolved into tariff wars and now we are possibly at the beginning of currency wars,” Patel had said. The IMF in its India country report released last week noted that the country was affected by the emerging market turmoil since mid-April. Portfolio outflows from India were relatively large, triggered by the run-up in international oil prices and tighter global financial conditions, as well as domestic concerns over fiscal slippages and the banking system’s exposure to the sovereign.

From end-March 2018 to early-August, 2018, India’s foreign exchange reserves are down by $21.84 billion, to $402.7 billion.

The IMF said this episode of capital reversal has been less intense than the 2013 taper tantrum, thanks to India’s stability-oriented policies and progress with structural reforms in recent years. The RBI accelerated the scaling back of its net forward foreign exchange position, which has been ongoing since September 2017.

Disclaimer:-The views and investment tips expressed by investment experts are their own. Ripples Advisory advises users to check with certified experts before taking any investment decisions.

Two days Free Trial and best services packages for dealing in Stock market click here to get >> Share Market Tips By Ripples Advisory Give a Missed call @9644405056

Comments

Post a Comment