Market Live: Weakness on indices continues as Sensex falls over 200 points; Nifty below 10,200

Market Live Nifty below 10,200, Sensex down 200 points; paint stocks under pressure

Market Update Equity benchmarks have continued to trade lower, with the Sensex falling over 250 points, while the Nifty traded below 10,200-mark.

The Sensex is down 268.66 points or 0.79% at 33865.72, while the Nifty is down 85.30 points or 0.83% at 10160.00. The market breadth is negative as 397 shares advanced, against a decline of 1,095 shares, while 2,080 shares were unchanged.

Shares of IndusInd Bank and Tata Motors are the top gainers, while Asian Paints, ONGC and HPCL have lost the most.

Asian Paints down 4 percent, while Sun Pharma, Titan is trading marginally lower.

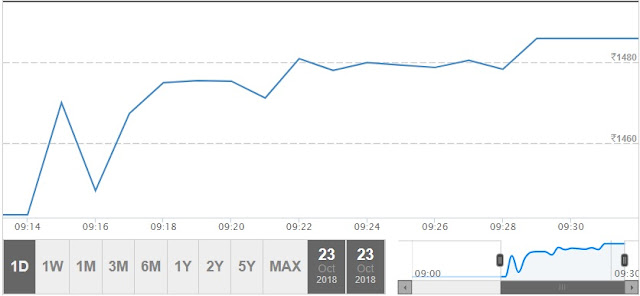

Shares of IndusInd Bank are up over 3 percent after having a sharp fall on Monday. Here is a look its intraday chart.

Result Reaction: Shares of Asian Paints fell 5 percent in early trade after the company posted a drop in profit. The company reported a Q2 net profit of Rs 506 crore, down from Rs 593.66 crore year on year (YoY). Also reported an operating margin of 16.9 percent, as against 18.8 percent YoY.

Rupee Updates: The Indian rupee slipped in the early trade on Tuesday. It opened lower by 14 paise at 73.70 per dollar against previous close 73.56.

On Monday, it closed lower by 24 paise versus Friday's close of 73.32 per dollar.

Market Opens: Benchmark indices slipped in the early trade on Tuesday with Nifty falling below 10,200 marks, while Sensex is down over 200 points.

The Sensex is down 231.71 points or 0.68% at 33902.67, and the Nifty down 72.80 points or 0.71% at 10172.50.

Asian Paints down 4 percent, while Sun Pharma, Titan is trading marginally lower.

Market at pre-opening: The benchmark indices are trading mixed in the pre-opening trade on Tuesday.

The Sensex is down 157.87 points or 0.46% at 33976.51, and the Nifty down 27.90 points or 0.27% at 10217.40.

Asian Paints slipped 10 percent on weak second-quarter numbers. Kotak Mahindra Bank is trading firm, while DHFL is down 9 percent.

Ambuja Cements Q2 preview: The company is likely to report a profit after tax (PAT) of Rs 350 crore for the September quarter, according to Motilal Oswal’s estimates. Meanwhile, Prabhudas Lilladher expects PAT at Rs 271.7 crore for the quarter under review.

Gold Update: Gold prices inched up early Tuesday as Asian stocks faltered, weighed down by political tensions between Saudi Arabia and Western powers, uncertainties around Brexit and Italy's budgetary woes, reported Reuters.

Crude Update: Oil prices were steady on Tuesday as Saudi Arabia pledged to play a "responsible role" in energy markets, although sentiment remained nervous in the run-up to US sanctions against Iran's crude exports that start next month, reported Reuters.

Asian Markets trade lower: Asian shares edged lower on Tuesday as earnings season nerves in the US dented Wall Street, while a cocktail of negative factors from Saudi Arabia's diplomatic isolation to concerns over Italy's budget and Brexit talks depressed sentiment, reported Reuters.

SGX Nifty: Trends on SGX Nifty indicate a negative opening for the broader index in India, a fall of 75.50 points or 0.74 percent. Nifty futures were trading around 10,176.50-level on the Singaporean Exchange.

Wall Street ends lower: The S&P 500 and the Dow fell in choppy trading on Monday as energy and financial stocks lost ground and caution grew ahead of a slew of earnings reports this week, reported Reuters.

Disclaimer:- The views and investment tips expressed by investment experts are their own. Ripples Advisory advises users to check with certified experts before taking any investment decisions.

Best Share Market News, Click Here To Get More News - Share Market Tips, for 2 Days Free Trial give a missed call @9644405056 and Get Share Market Services.

Comments

Post a Comment